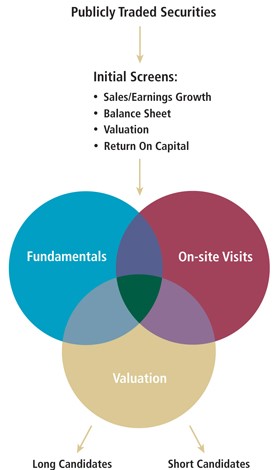

Our investment approach emphasizes on-site meetings with the companies in which we invest. On an annual basis, we typically have hundreds of meetings with management teams. Through these meetings we:

Once we have collected data and formed a view about a company’s growth prospects, we typically build financial models and establish valuation targets. Importantly, businesses are not static, so it is imperative to regularly update our inputs so that our financial models and valuation targets reflect current information.

The portfolio construction takes into account valuation work, growth prospects and an assessment of how macroeconomic trends are affecting individual companies and industries. Our goal is to assemble a diverse portfolio of attractively valued stocks in businesses that we believe are poised to deliver above average growth. In addition to monitoring and updating the portfolio holdings, we are on the hunt to discover new opportunities to upgrade the portfolio.

“We believe that visiting companies offers unique insights into an enterprise's growth prospects and competitive advantages.”

Chip Paquelet